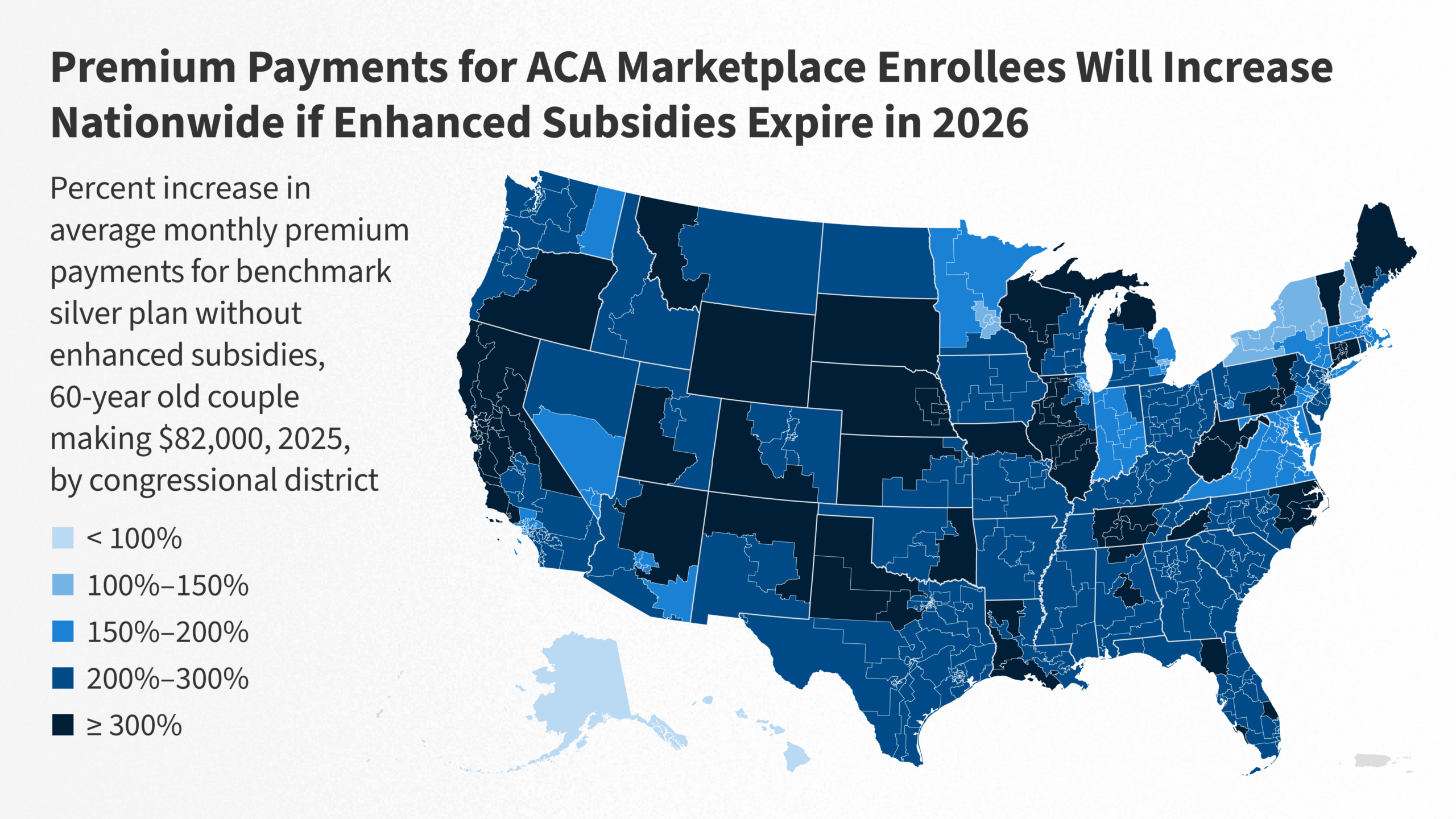

Millions of Americans rang in 2026 facing a harsh reality: the expiration of enhanced Affordable Care Act (ACA) subsidies that had slashed premiums for lower- and middle-income households. Overnight on January 1, these temporary tax credits—originally enacted during the COVID-19 pandemic and extended by Democrats—vanished, triggering premium hikes that could double or triple for many enrollees.

This policy cliff sets the stage for a bruising political fight, with a House vote expected in early January testing President Donald Trump’s second-term coalition amid growing GOP fractures. Moderate Republicans have joined Democrats in pushing for a three-year extension, but Senate rejection of similar bills in December dims prospects for quick relief.

Roots of the subsidy explosion

The enhanced premium tax credits first rolled out in 2021 as part of pandemic relief, allowing many enrollees to pay zero premiums and expanding eligibility up to 400% of the federal poverty level (about $62,600 for an individual or $128,600 for a family of four). Without them, baseline ACA subsidies cap contributions at around 8.5% of income for those below 400% FPL, but premiums now revert to pre-2021 levels—often unaffordable.

Enrollment in ACA marketplaces hit record highs of over 21 million for 2025, largely thanks to these boosts, with states like Pennsylvania and Massachusetts reporting early payment drops signaling trouble ahead. Families now confront bills jumping from $0 to hundreds monthly; one analysis projects 4-5 million could drop coverage by mid-year without action. Exchange operators prepare for chaos, with automatic renewals at higher rates and special enrollment windows if Congress acts later.

Trump’s administration accelerated the squeeze via 2025 budget reconciliation, slashing over $1 trillion in health spending and eliminating repayment limits on excess credits—meaning enrollees owe full back amounts on 2026 taxes. Lawfully present immigrants, including refugees and DACA recipients, face new barriers, with 1.4 million projected to lose access by 2034 per Congressional Budget Office estimates.

Washington’s shutdown drama and Trump retreat

The path to expiration was paved with partisan gridlock. Democrats triggered a 43-day government shutdown in late 2025 demanding extension, while moderate Republicans warned of 2026 midterm wipeouts in swing districts where health costs rank top voter concerns. President Trump initially floated a compromise—capping subsidies at 700% FPL with minimum premiums—but pulled back after conservative fire, prioritizing tax cuts and spending restraint.

In December, the Senate tanked a Democratic three-year extension and a GOP health savings account alternative. Now, four centrist House Republicans have defected, teeing up a January 5-10 vote on revival. Success hinges on Trump’s sway: allies like Sen. Bill Cassidy eye bipartisan tweaks, but hardliners demand market-based reforms like expanded catastrophic plans and streamlined hardship exemptions.

Open enrollment deadlines passed December 15 (with January 15 extensions for some), locking many into pricier 2026 plans. States like Massachusetts have “plans on the shelf” for rapid subsidy reinstatement if passed, but federal delays could mean months of elevated costs before refunds.

Voter backlash and 2026 midterm dynamite

This unfolds as Republicans defend slim majorities ahead of 2026 midterms, where historical trends favor the opposition. Polls show health care rivaling inflation as a top issue, with subsidy loss amplifying perceptions of Trump’s “big beautiful bill” as favoring the wealthy. Democrats brand it a “New Year’s betrayal,” rallying base turnout in purple suburbs.

GOP vulnerabilities peak in districts like those held by moderates who broke ranks—areas with high ACA reliance. If premiums spike 50-100% as projected, expect attack ads framing Republicans as “cutting care for cronies.” Trump could pivot to short-term relief via executive action on catastrophic plans, but full repeal remains off-table amid public backlash.

Bipartisan senators discuss income caps and work requirements as olive branches, potentially passing a slimmed extension by Q1. Failure risks 10-15% uninsured rate jumps, straining hospitals and boosting emergency costs nationwide.

What families face now—and paths forward

Real-world pain hits immediately. A family of four earning $80,000 might see premiums leap from $200 to $800 monthly; lower-income households from free to $300+. Marketplace call centers brace for surges, urging shopping for cheaper silver plans despite higher deductibles.

Options include employer plans, Medicaid expansion (in 40 states), or short-term policies Trump favors—but the latter lack ACA protections. Exchanges push new enrollments as key metrics; early 2026 data could show 2-3 million dropouts by April if unpaid premiums trigger cancellations.

For revival: Watch the House vote. Passage sends it to a GOP Senate needing defectors; Trump tie-breaker via veto threats or endorsement. If stalled, reconciliation offers a partisan path, but delays relief to summer. States like California and New York explore workarounds via their exchanges.

Longer-term, 2026 politics ignite full ACA debates. Trump’s team eyes broader reforms—health savings accounts, interstate sales—while Democrats push Medicare expansion. With midterms looming, this shock could redefine the map, punishing inaction. Premium notifications hit inboxes this week; millions now bet on Washington delivering before costs break them.