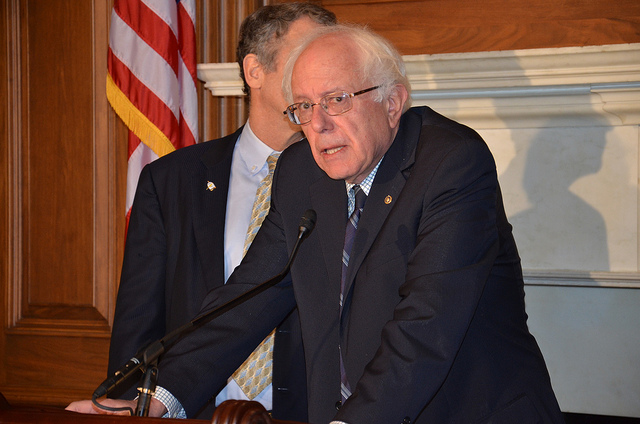

Bernie Sanders brutal honesty and no non-sense approach has made FeelTheBern all the more real. Now Sanders has turned his eye to big business and has called out some of the most corrupt and vile CEOs in corporate America or as Conservatives call it “good business.”

[wp_ad_camp_3]

Sanders call out began with a letter in the Wall Street Journal that said:

There really is no shame. The Wall Street leaders whose recklessness and illegal behavior caused this terrible recession are now lecturing the American people on the need for courage to deal with the nation’s finances and deficit crisis. Before telling us why we should cut Social Security, Medicare and other vitally important programs, these CEOs might want to take a hard look at their responsibility for causing the deficit and this terrible recession.

Better yet Sanders like any true researcher or politician backed up his guns with the actual report on how these 18 CEOs are to blame for the deficit. First up we have:

Bank of America CEO Brian Moynihan

The amount of federal income taxes paid in 2010? Zero. $1.9 billion tax refund.

Federal Reserve and the Treasury Department Taxpayer Bailout Over $1.3 trillion.

The amount of federal income tax Bank of America would have owed had offshore tax havens been eliminated? $2.6 billion.

Goldman Sachs CEO Lloyd Blankfein

The amount of federal income taxes paid in 2008? Zero. $278 million tax refund.

Federal Reserve and the Treasury Department Taxpayer Bailout: $824 billion.

Amount of federal income taxes Goldman Sachs would have owed had offshore tax havens been eliminated? $2.7 billion

JP Morgan Chase CEO James Dimon

Federal Reserve and the Treasury Department Taxpayer Bailout: $416 billion.

Amount of federal income taxes JP Morgan Chase would have owed had offshore tax havens been eliminated? $4.9 billion.

General Electric CEO Jeffrey Immelt

The amount of federal income taxes paid in 2010: Zero. $3.3 billion tax refund.

Federal Reserve and the Treasury Department Taxpayer Bailout: $16 billion.

Number of job shipped overseas: At least 25,000 since 2001.

Verizon CEO Lowell McAdam

The amount of federal income taxes paid in 2010: Zero. $705 million tax refund.

[wp_ad_camp_2]The amount of federal income taxes paid in 2010: None. $124 million tax refund.

Number of American jobs shipped overseas: Over 57,000.

The amount of Corporate Welfare: At least $58 billion.

Microsoft CEO Steve Ballmer

The amount of federal income taxes Microsoft would have owed had offshore tax havens been eliminated? $19.4 billion.

Honeywell International CEO David Cote

The amount of federal income taxes paid from 2008-2010: Zero. $34 million tax refund.

Corning CEO Wendell Weeks

The amount of federal income taxes paid from 2008-2010: Zero. $4 million tax refund.

Time Warner CEO Glenn Britt

The amount of federal income taxes paid in 2008: Zero. $74 million tax refund.

Merck CEO Kenneth Frazier

The amount of federal income taxes paid in 2009: Zero. $55 million tax refund.

Deere & Company CEO Samuel Allen

The amount of federal income taxes paid in 2009: Zero. $1 million tax refund.

Marsh & McLennan Companies CEO Brian Duperreault

The amount of federal income taxes paid in 2010: Zero. $90 million refund.

Qualcomm CEO Paul Jacobs

The amount of federal income taxes Qualcomm would have owed had offshore tax havens been eliminated: $4.7 billion.

Tenneco CEO Gregg Sherill

The amount of federal income taxes Tenneco would have owed had offshore tax havens been eliminated: $269 million.

Express Scripts CEO George Paz

The amount of federal income taxes Express Scripts would have owed had offshore tax havens been eliminated: $20 million.

[wp_ad_camp_1]

Caesars Entertainment CEO Gary Loveman

The amount of federal income taxes Caesars Entertainment would have owed had offshore tax havens been eliminated: $9 million.

R.R. Donnelly & Sons CEO Thomas Quinlan III

Amount of federal income taxes paid in 2008? Zero. $49 million tax refund.

PoliticusUSA discloses, disclosed that these eighteen who signed the call for deficit action are actually some of the biggest outsourcers and tax cheats in America history. They crashed the economy in 2008, but then followed that incident by taking billions in taxpayer bailout dollars.

Thankfully, Senator Sanders is not standing for the corruption by putting the spotlight on these double standards

For those conservatives out there who complain about spending and the national deficit here’s a final fast fact for you. Since 2008, the American spending gap has totaled 6.716 trillion. If just those 18 CEOs paid their taxes nearly 500 billion dollars would be cut form the deficit in spending.

All data courtesy of Top Corporate Dodgers report

Image courtesy of AFGE